We’re moving our liquidity incentivization to Bunni protocol stake, where APRs will be significantly higher.

From May 12th, we will be turning off DOP-ETH incentives on Drops and fully move to incentivizing on Bunni protocol.

How To Migrate Liquidity from Uniswap V2 To Bunni

Here’s how you can transition from staking DOP-WETH Uniswap V2 to providing liquidity to Bunni in 4 steps:

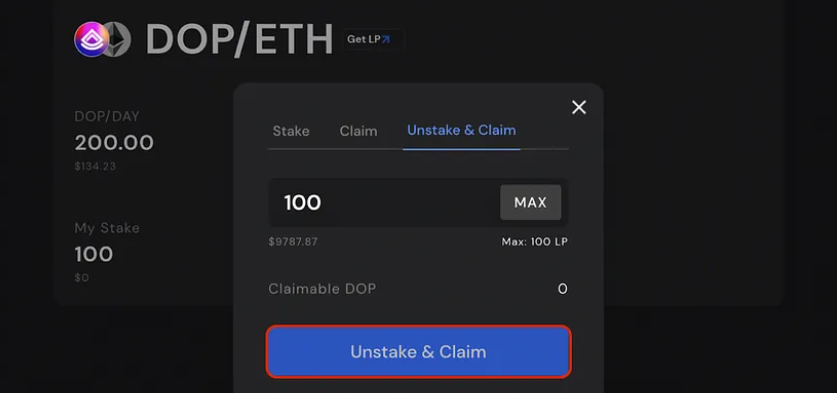

- Visit Drops.co to unstake your Uniswap V2 LP tokens.

Select the “Stake” tab and click “Select” on the DOP/ETH pair. Select “Manage” then enter the amount you wish to remove. Click “Unstake & Claim” to complete the unstaking process.

2. Visit Uniswap V2 to remove your LP tokens

Go to pools and select the appropriate DOP liquidity pair that appears under “Your V2 Liquidity.”

Select the amount you wish to remove, and confirm the transaction to receive back your DOP and WETH as separate tokens.

3. Stake your DOP and WETH (or ETH) In Bunni

Go to A and scroll down to DOP/WETH. Click on the pair and then select “Add liquidity”. Submit the liquidity that you wish to add. This will take a few transactions, as you will need to approve each token before submitting the liquidity.

4. Stake your Bunni LP tokens

In the same place in Bunni, navigate to the “Stake” tab and enter the quantity of BUNNI-LP tokens you wish to stake (or click the “Max” button). Click the “Stake” button at the bottom and confirm the transaction.

And there you have it! You’ve migrated your DOP LP staking and will be earning the incentivized APR rate on Bunni.

Bonus strategy — how to maximize yield on Bunni

APR rates on Bunni can be boosted up to 10 times from the base APR. To obtain that boost it’s required to obtain Bunni governance tokens LIT and stake them to obtain veLIT balance. You can find a calculator on Bunni LP staking module to estimate how much veLIT is required to maximize yield.

English

English

Deutsch

Deutsch

Español

Español

Français

Français

Português

Português

日本

日本

한국인

한국인

Türkçe

Türkçe

Русский

Русский

Tiếng Việt

Tiếng Việt