Velvet DAO is set to revolutionize DeFi!

Join top web3 builders, giga-brains, fund managers, & investors in Velvet DAO & help build the future of DeFi!

LSDs Take DeFi World By Storm

In DeFi, the largest category by TVL has become Liquid Staking Derivatives (LSDs). LSDs have come storming onto the DeFi scene and transformed the staking landscape seemingly overnight. They offer a unique solution to the liquidity constraints of traditional staking models.

What Are Liquid Staking Derivatives?

Simply put, LSDs are tokenized representations of staked assets. In traditional staking models, tokens are locked in a network to support block validation and transaction processing operations. While this provides stakers with rewards, it also ties up their assets, limiting their liquidity and creating large opportunity costs.

LSDs address this liquidity issue by providing stakers with derivative tokens in exchange for their staked assets. These derivative tokens represent a claim on the staked assets and the rewards they generate. Importantly, these derivative tokens can be traded, sold, or used in other DeFi applications, providing stakers with liquidity while still allowing them to earn staking rewards.

Creating LSDs

The process of creating LSDs begins when a user stakes their tokens through a liquid staking provider. The provider then issues the user with an equivalent amount of LSDs, which are pegged to the value of the staked tokens. These LSDs can then be used within the DeFi ecosystem, providing the user with liquidity and the potential for additional yield!

The staking rewards generated by the staked tokens are distributed to the holders of the LSDs — providing them with a return on their staked assets. The distribution of these rewards is typically proportional to the amount of LSDs held by each user.

Several platforms have emerged as the leaders in the LSD market, some being Centralized Staking providers and others being decentralized on-chain. Most Centralized providers charge higher fees than decentralized protocols but can attract new users due to the ease of use.

Lido Finance

Lido Finance is the pioneer and currently the largest provider of LSDs. They issue a derivative token called stETH in return for staked ETH. Lido’s stETH can be used in many DeFi protocols, providing users with a wide range of opportunities for yield generation.

Since its release in late 2020, Lido TVL has grown to almost $15 Billion (67% Market Share). Its peak in TVL occurred before the collapse of Terra Luna in May of 2022 (which went from about $7B to 0 in a few days) when the TVL was $19 Billion.

On May 15th, Lido released their V2 on Ethereum which allowed users to exit their stETH and receive ETH at a 1:1 ratio. Even with withdrawals enabled, the amount of ETH staked on Lido has continued to rise.

Currently, the APR when Liquid Staking on Lido is 4.01% on Ethereum, 4.3% on Polygon, and 5.9% on Solana.

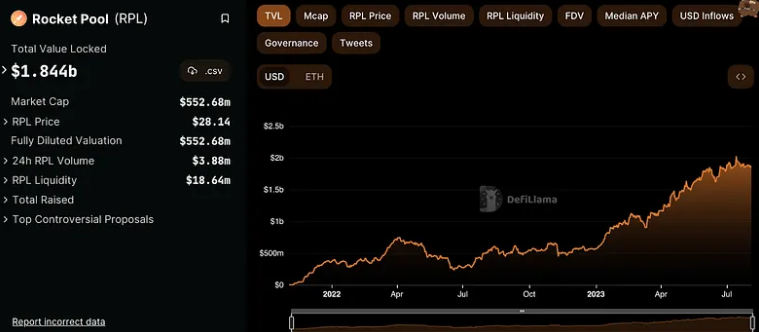

Rocket Pool

Rocket Pool offers a more decentralized approach to liquid staking.

Rocket Pool allows anyone to be a node operator and has about 28 times the amount of operators as its next largest peer by node operators (Strader which also allows anyone to be a node operator).

Their staking works by pairing rETH depositors with independent node operators, reducing the risk of centralization. While Rocket Pool’s market share is currently smaller than Lido’s their commitment to decentralization may appeal to users concerned about the centralization risks associated with other providers.

Since its release in November 2022, Rocket Pools TVL has grown exponentially and reached $1.8 Billion (8.5% Market Share). Becoming the 3rd largest liquid staking provider behind Lido and Coinbase Wrapped Staked ETH.

The current APR on Rocket Pool is 7.9% for node operators who stake and 5.1% for stakers.

The Growth and Future of Liquid Staking Derivatives

The LSD market has experienced significant growth driven by the increasing demand for liquidity in the DeFi space. The recent Ethereum upgrade, Shapella, has further fueled this growth by allowing users to unstake their ETH, freeing up previously locked assets and leading to a significant influx of ETH into the LSD market.

Looking ahead, the growth of the LSD market is likely to continue, driven by the ongoing demand for liquidity and the increasing adoption of DeFi.

English

English

Deutsch

Deutsch

Español

Español

Français

Français

Português

Português

日本

日本

한국인

한국인

Türkçe

Türkçe

Русский

Русский

Tiếng Việt

Tiếng Việt